Blog

Must Gig-workers Pay Tax?

Written by Prisca Ang, Straits Times

Credit: Straits Times 5 April 2023 | Prisca Ang | ST Explains: If I’m a gig worker, do I need to report my income to Iras? | The Straits Times

ST Explains: If I’m a gig worker, do I need to report my income to Iras?

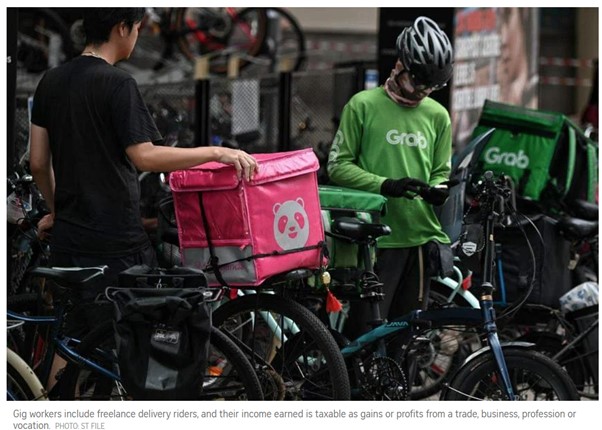

SINGAPORE – Gig income earned is taxable as gains or profits from a trade, business, profession or vocation, said the Inland Revenue Authority of Singapore (Iras).

Gig workers, who are generally self-employed, include independent consultants, coaches, online graphic designers, freelance delivery riders, private-hire car drivers, home tutors, babysitters and home bakers. “You are a gig worker if you provide your services under a contract for service to earn an income,” said Iras.

“Common compliance risks of the gig economy include under-reporting or omission of income and poor record-keeping practices,” it added.

Gig workers who fail to report their income will face penalties, prosecution or both, said Iras, which also urged taxpayers to immediately disclose past tax errors.

It noted that penalties will not be imposed if the disclosure is made within the grace period of a year from the statutory filing deadline and meets certain qualifying conditions. It will also treat such disclosures as a mitigating factor when considering action to be taken.

If you are a gig worker, these are some things you need to know when filing your taxes for year of assessment (YA) 2023 for income earned from Jan 1 to Dec 31, 2022.

Q: I did not get a tax form or filing notification. Do I still need to file my taxes?

A: Yes, if your annual net trade income exceeded $6,000, or if your total income from all sources, such as trade, employment or rent, was more than $22,000. If you are filing your taxes for the first time, you can e-mail Iras to activate your myTax Portal account.

Q: Do I need to report my income to Iras?

A: Payments in exchange for work done can take the form of money, goods or services. Both monetary and non-monetary payments or benefits in kind are taxable as gains or profits from a trade, business, profession or vocation, even if the activities are carried out on a part-time or casual basis.

A hobby such as baking for family and friends is generally not considered a business, and income earned from such activities is not taxable. But it will be taxable if the activities are performed repeatedly in exchange for monetary or non-monetary benefits.

You have to declare your income under the “Trade, Business, Profession or Vocation” section of your individual income tax form for YA2023.

Q: Are my service fees subject to tax if they were paid by overseas customers?

A: If your services were performed in Singapore, the income is subject to tax here, regardless of whether the payment was made overseas or by overseas customers.

Q: Can I claim business expenses as tax deductions?

A: The expenses must be related to the performance of your gig work – staff costs, finance, professional costs like interest on loans and running costs like advertising fees. Iras stressed the importance of keeping proper records and accounts, supported by invoices, receipts, vouchers and other documents, as it may verify them.

Q: How do I value non-monetary benefits received?

A: The taxable value of the products and services will generally be their market retail price. If this is not readily available, the market retail price of similar products and services can be used as a proxy.

If the product or service is a niche item that cannot be found in the open market, the recipients may obtain the value of the item from its providers.

Q: Do I need to contribute to MediSave?

A: MediSave contributions are compulsory for all self-employed citizens or permanent residents. If you earn a net trade income of more than $6,000 a year, you must contribute to MediSave.

You can refer to the Central Provident Fund (CPF) Board website for more details on the contribution rates and use the Self-Employed MediSave Contribution Calculator.

Iras will send a Notice of Computation after assessing your actual income, to inform you of the MediSave amount you need to contribute to your CPF. However, you do not need to wait for the notice and can make contributions throughout the year.

Q: Can I claim CPF relief for compulsory MediSave contributions and voluntary CPF contributions?

A: You may claim tax relief of 37 per cent of your net trade income assessed; your CPF annual limit of $37,740; or the actual amount you contributed in 2022 – whichever is lowest.

You do not need to make a claim in your tax return as the relief will be given automatically to you based on information from the CPF Board. No relief will be allowed for these areas if you have no assessable net trade income for YA2023.

A Requiem for Retirement

Written by Luke Thomas

Sequenting: Jettisoning Retirement and financing a multi-stage life

Written by Luke Thomas

Retirement – The lies we tell

Written by Luke Thomas

What for Retirement?

Written by Luke Thomas

Retire beyond work and age

Written by Ashish Marwah

The Rise of Silver Mentors

Written by Ashish Marwah

‘Granny Battering’. We all do it.

Written by Ashish Marwah

A Point of View on Ageism

Written by Ashish Marwah

Bridging Generational Divides in Your Workplace

Written by Debra Sabatini Hennelly and Bradley Schurman

Eligible Platform Workers Get CPF Boost

Written by Chor Kieng Yuit, Straits Times

More Companies Are Using Marketplaces To Find Freelance Workers

Written by Luke Thomas

Hiring Independent Professionals Need Not Be Painful

Written by Luke Thomas