Blog

Eligible Platform Workers Get CPF Boost

Written by Chor Kieng Yuit, Straits Times

Credit Straits Times 28 March 2023 | Chor Kieng Yuit | Eligible platform workers to get boost in CPF savings, cushion to protect take-home pay | The Straits Times

Eligible platform workers to get boost in CPF savings, cushion to protect take-home pay

SINGAPORE - Platform workers, such as those partnering Grab or Deliveroo, will get help in beefing up their savings for housing and retirement, while the impact on their take-home earnings is cushioned.

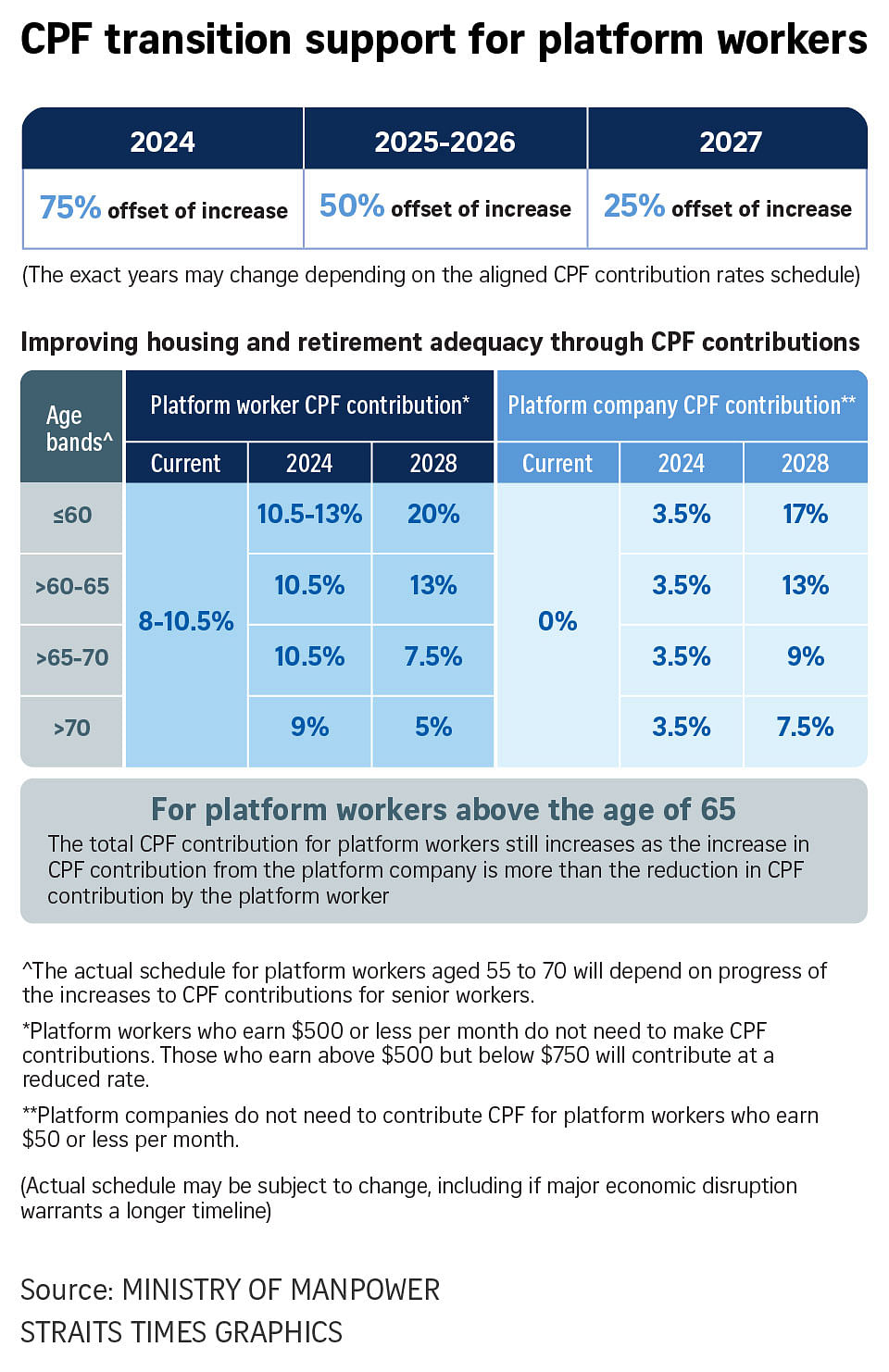

Even as these workers and platform companies are asked to contribute to the Central Provident Fund (CPF) like regular employees and employers, there will be transition support to protect take-home earnings.

Platform workers who align their contributions to those of regular employees earlier will receive stronger support, said Senior Minister of State for Manpower Koh Poh Koon on Wednesday.

And once the platform workers’ CPF contribution rates have been fully aligned with those of employees, those eligible for the Workfare Income Supplement will have their payments permanently increased to match those of regular employees.

These measures aim to address the concerns among platform workers about a drop in take-home pay amid changes to CPF contributions that will kick in from the second half of 2024.

Platform workers are self-employed, and include delivery workers, private-hire car drivers and taxi drivers.

The transition support will apply for lower-income platform workers who earn $2,500 or less per month and are contributing CPF payments.

Those below 30 in 2024, meaning those born in or after 1995, will have to make higher contributions, while older platform workers can choose to opt in or not.

The contributions will be increased evenly over five years, at around 2.5 percentage points per year.

In response to Progress Singapore Party Non-Constituency MP Hazel Poa’s question on whether older platform workers can opt out after they decided to opt in to the CPF contributions, Dr Koh said the decision to opt in is irreversible, which means older platform workers who chose to opt in cannot opt out after that.

“Staying committed to these CPF contributions and allowing the earnings to accumulate interest over time is what will help platform workers develop housing and retirement adequacy,” Dr Koh said.

Currently, they make CPF contributions only to their MediSave accounts for their healthcare needs.

He added that older cohorts of platform workers can also benefit from additional contributions by platform companies.

“With the additional CPF contributions from platform companies, workers above 65 will be able to receive the same level of CPF contributions (16.5 per cent in 2028) as regular employees of the same age without having to make additional CPF contributions themselves.”

Dr Koh cited a study which showed that younger platform workers wanted additional CPF contributions to help meet their housing needs.

He also addressed the worries and concerns of the platform companies and older platform workers over the latest move.

Some older workers were worried that if they opted in for the scheme, their companies may assign them less work (since contributing to their CPF would make such workers more expensive for the companies).

He said companies should not discriminate against such workers. “MOM will investigate any unfair practices,” Dr Koh added.

Acknowledging the cost implications of the move, he said each stakeholder had to play a part, including consumers.

“Singaporeans, as consumers, are willing to bear increases in costs to platform services, knowing that their contributions will make a difference to enhance protections for platform workers,” said Dr Koh.

The measures would ensure that platform workers receive a significant boost to their retirement savings, while their take-home pay is cushioned.

Take, for example, a median income platform worker who turns 30 in 2024 and who earns $2,000 (after expenses) per month.

If he chooses to opt in to the aligned CPF contribution rates from the start, on average, this person’s CPF contributions will increase by $50 per month, which will go into his CPF Ordinary Account and Special Account.

It is also estimated that he can use about $450,000 in CPF savings by age 65 for housing and retirement needs.

Once their CPF contribution rates are aligned in 2028, eligible platform workers will get higher payments under the Workfare Income Supplement (WIS) scheme.

The payment amounts will match those of regular employees.

Dr Koh said eligible platform workers could receive up to $4,200 per year, which represents an increase from $2,800 per year currently.

He said 40 per cent of the payment ($1,680) will be given in cash, compared with 10 per cent at present.

Dr Koh added that all platform workers eligible for WIS will also start to receive their WIS payments monthly instead of yearly.

The monthly payment applies to platform workers who opt in or are required to make CPF contributions and those who do not make CPF contributions.

A Requiem for Retirement

Written by Luke Thomas

Sequenting: Jettisoning Retirement and financing a multi-stage life

Written by Luke Thomas

Retirement – The lies we tell

Written by Luke Thomas

What for Retirement?

Written by Luke Thomas

Retire beyond work and age

Written by Ashish Marwah

The Rise of Silver Mentors

Written by Ashish Marwah

‘Granny Battering’. We all do it.

Written by Ashish Marwah

A Point of View on Ageism

Written by Ashish Marwah

Bridging Generational Divides in Your Workplace

Written by Debra Sabatini Hennelly and Bradley Schurman

Must Gig-workers Pay Tax?

Written by Prisca Ang, Straits Times

More Companies Are Using Marketplaces To Find Freelance Workers

Written by Luke Thomas

Hiring Independent Professionals Need Not Be Painful

Written by Luke Thomas